AFL allows traders to quickly check and evaluate a lot of stocks and portfolios. Therefore, the odds of finding lucrative buying and selling opportunities increase.

Besides The three Amibroker Datafeed Solutions detailed earlier mentioned, there are numerous Other folks that we haven’t analyzed nonetheless but They can be truly worth having a look at:

AmiBroker comes preloaded with sample DJIA parts database. You are able to update this sample database (and almost every other US & copyright marketplace databases) which has a new rates applying supplied AmiQuote method. Later In this particular tutorial you'll find thorough instructions on how to use AmiQuote.

Applying the above-shown AFL, it's possible you'll pick a script determined by your needs and specialized Investigation competencies to trade in the market.

The perfect Amibroker data feed may differ with the trading strategy, encounter, and money that you've. Here are a few aspects to take into consideration:

are you able to remember to propose me data supplier for EURUSD …Dwell rapidly AND with backfill facility for amobroker

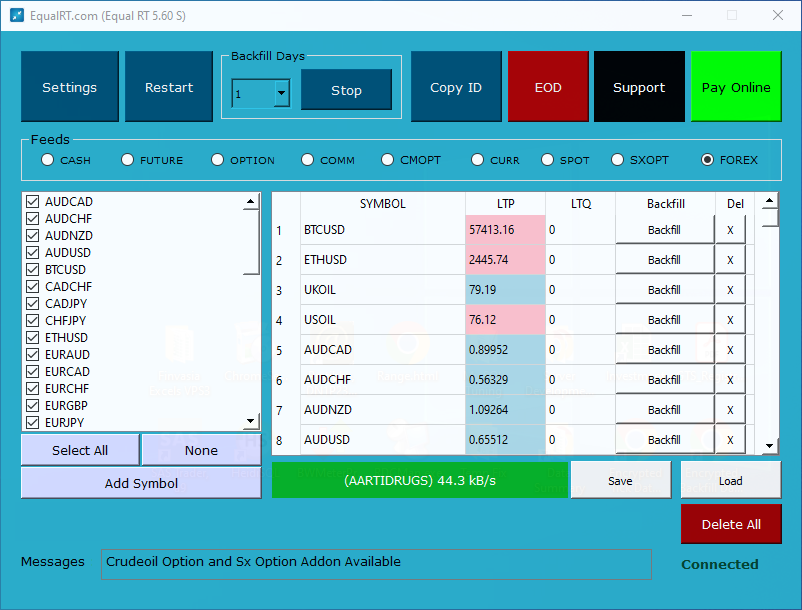

Configure - enables to Display screen data supply particular configuration dialog see Tutorial portion for specifics on configuring various data resources.

Clearly show day and evening session only - just the data in between both working day session start/stop time or night time session start/stop time are exhibited

Pressure backfill - this feature brings about that plugin re-downloads total (intraday) historical past through the server. Typically the plugin instantly handles all backfills which means you don't need to set off backfills by hand. If the plugin detects you have some lacking estimates from past offered bar till recent date/time it triggers backfills and it can be all automatic.

Harmonic Sample Dynamic Amounts AFL Swing investing is common among working day traders. Many chart analysts make use of harmonic patterns to forecast purchasing and providing options or expected stock reversals for varied equities according to historic data feed.

As for "automated backfill on initial data access" - when it is checked AmiBroker tries to backfill image if you Screen a chart for offered symbol (or accomplish backtest or scan).

Now the plugin tries to workaround this weirdness by ignoring replicate tickSize LAST_SIZE activities (Together with the very same dimensions) and correcting lacking ticks usign CUMULATIVE volume sent with tickSize VOLUME event. Correction is needed because without it we might finish up owning incorrect full quantity (often true trades could have exact same occasions so multiple Serious ticks can have similar price tag/measurement, unfortunatelly there's no way to detect When it really is real trade or copy generated by IB, so correction In keeping with cumulative quantity is the only technique to go).

Make it possible for combined EOD/Intraday data - it makes it possible for to work with database which has a mixture of intraday and EOD data in a single data file. If This is often turned on then in intraday modes EOD bars are eradicated on-the-fly As well as in day-to-day mode EOD bars are displayed instead of time compressed intraday or if there is not any EOD bar for corresponding working day then intraday bars are compressed as common.

From the Amibroker, System click here Language permits buyers to assemble their own trading technique or principles based mostly on their buying and selling encounters and Choices as a way to decide on the correct stocks and decide entry price ranges, end loss, and exit details.

The RT estimate window delivers real-time streaming estimates and a few standard elementary data. It can be quite easy to operate as shown in the picture beneath: